Accounting Equation: a Simple Explanation

Reading time: 6 mins

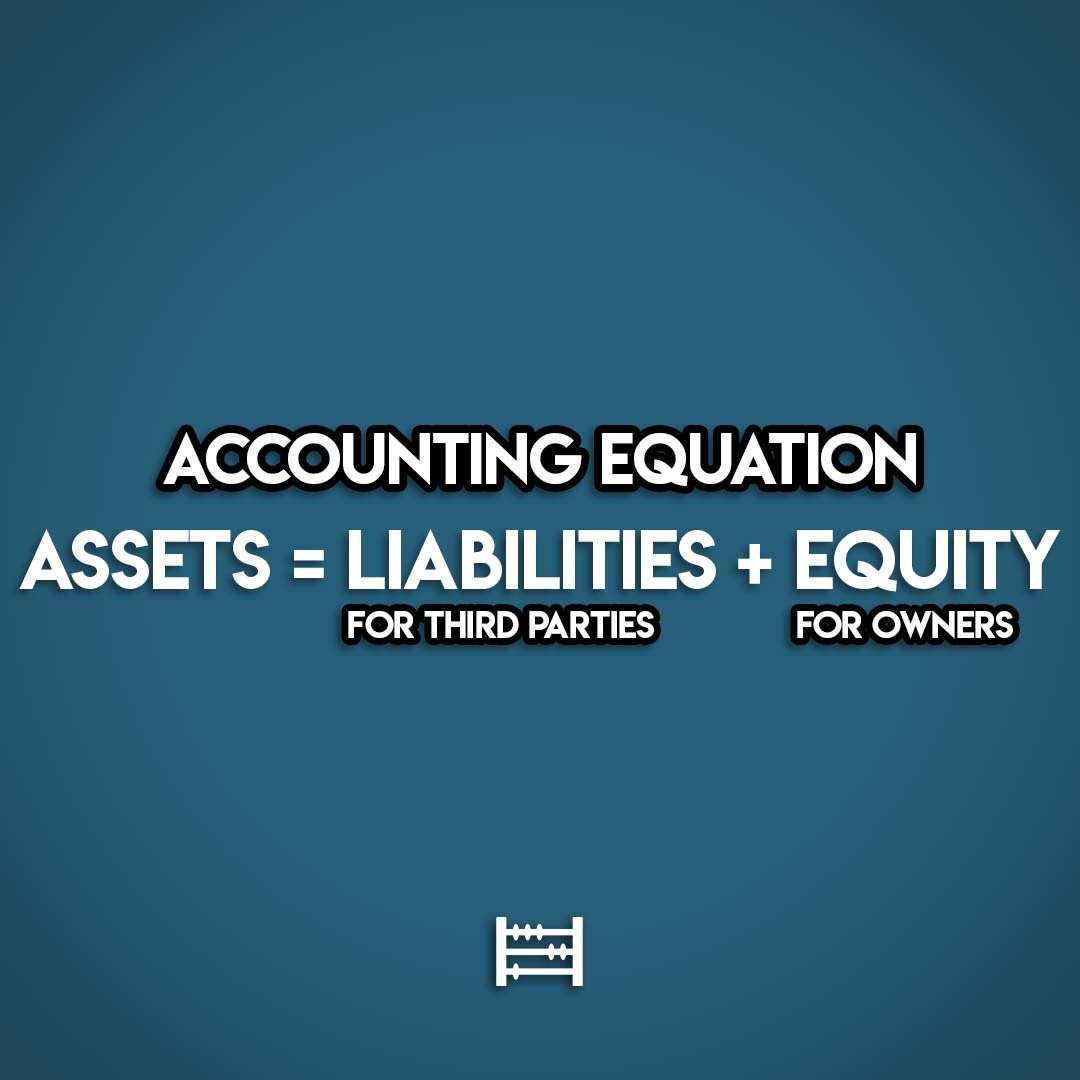

What is the Accounting Equation?

The Accounting Equation says that Assets are equal to Liabilities plus Equity.

Assets = Liabilities + Equity

This is a core principle of Accounting. The formula defines the relationship between a business's Assets, Liabilities and Equity. At any moment in time the Accounting Equation must balance. This lays the groundwork for Double-Entry Bookkeeping.

The Accounting Equation is also called:

the Accounting Equation Formula

the Balance Sheet Equation

Basic Accounting Equation

How does the Accounting Equation work?

The Accounting Equation tells us the stuff that a business owns is equal to the stuff that it owes.

Stuff that a business owns = Stuff that a business owes

A business owns Assets and owes Liabilities & Equity. Liabilities are owed to third parties, whereas Equity is owed to the owners of the business.

Which three components make up the Accounting Equation?

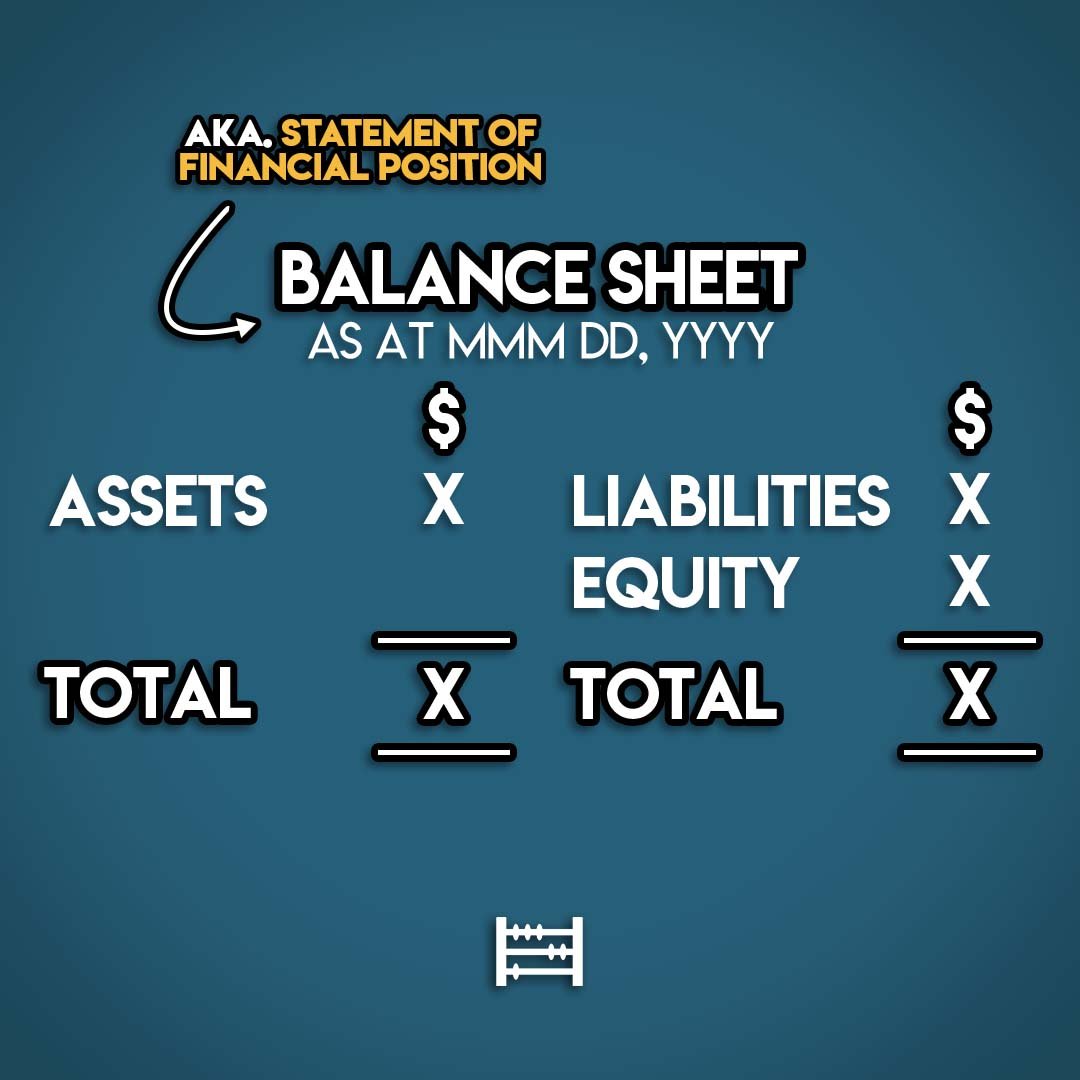

The accounting equation has three components: Assets, Liabilities and Equity. These are broken down on a business's Balance Sheet. The Balance Sheet is a Financial Statement that gives us a snapshot of a business's Assets, Liabilities and Equity at a point in time.

Let's take a closer look at each of these elements so that we can understand them better.

Assets

Assets are the stuff that a business owns that have value. They make up one side of the Accounting Equation. You can think of them as resources that a business controls due to past transactions or events. Assets can be current or non-current.

Current Assets

Current Assets are Short-Term Assets. These are expected to be converted into cash in under one year. They include:

Cash

Short-Term Investments

Accounts Receivable

Inventory

Accrued Revenue

Prepaid Expenses

Non-Current Assets

Non-Current Assets are Long-Term Assets. These aren't as easy to convert into cash. They are expected to be held for more than one year. They are made up of:

Long-Term Investments

Property, Plant & Equipment

Intangible Assets

Liabilities

Liabilities are the stuff that a business owes to third parties. Along with Equity, they make up the other side of the Accounting Equation. Liabilities are a business' obligations to third parties. They require a sacrifice of economic benefit in the future. Liabilities can also be Current or Non-Current.

Current Liabilities

Current Liabilities are Short-Term Liabilities. These are a business's obligations that need to be settled within one year. They include:

Accounts Payable

Salaries Payable

Taxes Payable

Accrued Expenses

Deferred Revenue

Short-Term Debt

Non-Current Liabilities

Non-Current Liabilities are Long-Term Liabilities. These are obligations that aren't expected to be settled within one year. These are some common examples of Long-Term Liabilities:

Long-Term Debt

Notes Payable

Equity

Equity is the stuff that a business owes to its owners. If we rearrange the Accounting Equation, Equity is equal to Assets minus Liabilities. Net Assets is the term used to describe Assets minus Liabilities.

Equity = Assets - Liabilities = Net Assets

So Equity is the owner's claim on the Net Assets of a business. It's made up of:

Capital Contributions

Retained Earnings

Accounting Equation Example

Let me show you how the Accounting Equation works with an example.

Storyteller's Corner is a bookstore. On December 31st, 20X5 they reported the following numbers on their Balance Sheet:

Total Assets: $100,000

Total Liabilities: $70,000

Total Equity: $30,000

On the left side of the Accounting Equation Storyteller's Corner has Total Assets of $100,000. On the right, they have Total Liabilities of $70,000 and Total Equity of $30,000. This adds up to $100,000 ($70,000 + $30,000). This matches their Total Assets on the left of the Accounting Equation.

Total Assets = Total Liabilities + Total Equity

What is Double-Entry Accounting?

In Double-Entry Accounting, there are at least two sides to every financial transaction. Every accounting entry has an opposite corresponding entry in a different account. This principle ensures that the Accounting Equation stays balanced.

For example, imagine that a business's Total Assets increased by $500. This change must be offset by a $500 increase in Total Liabilities or Total Equity.

Debits and Credits are the words used to reflect this double-sided nature of financial transactions.

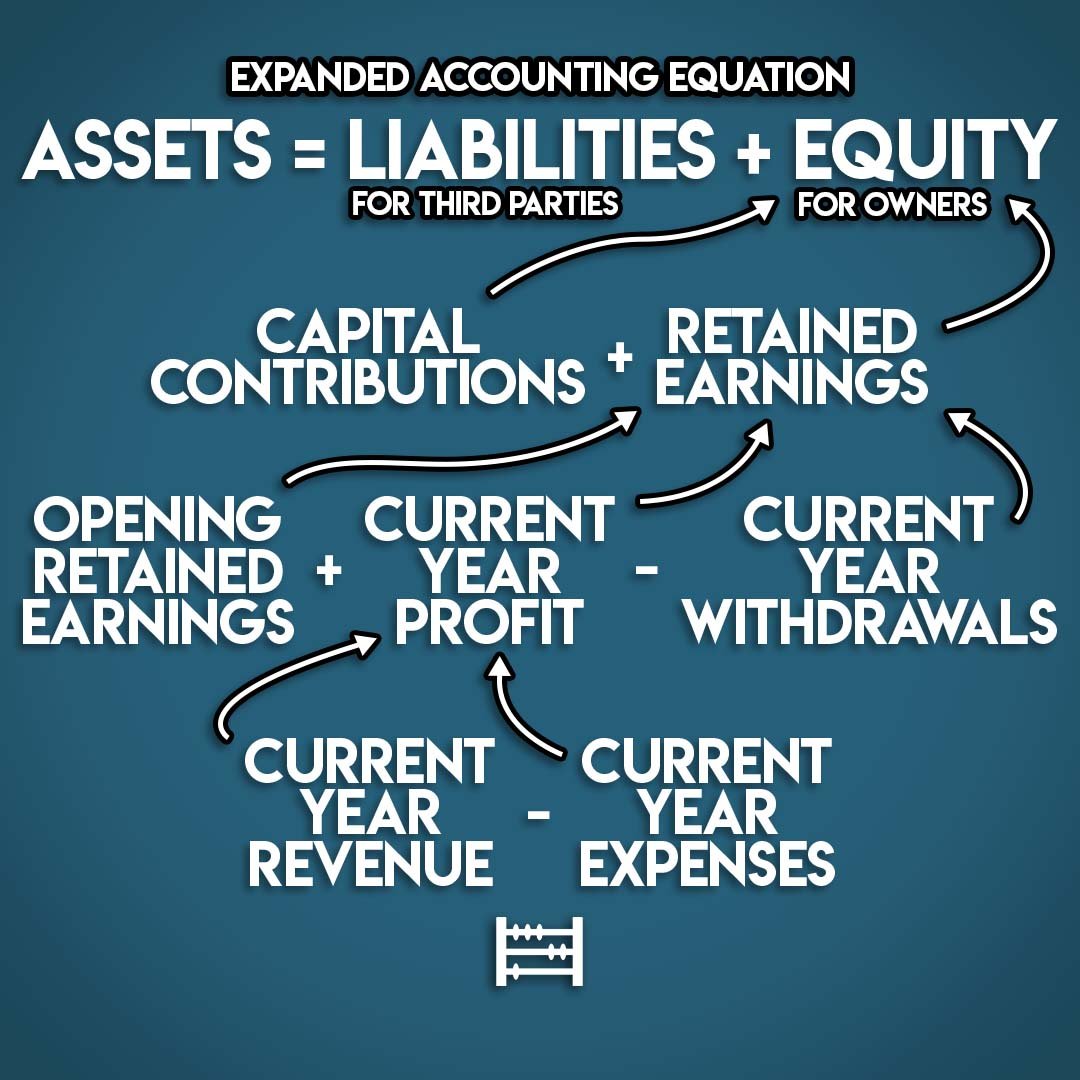

What is the Expanded Accounting Equation?

The Expanded Accounting Equation breaks Equity down into its core components. These include:

Capital Contributions: Funds invested into the business out of the owner's own pocket.

Opening Retained Earnings: Profits held for future use at the start of the accounting period.

Revenue: Income earned during the current year

Expenses: Costs incurred during the current year

Withdrawals: Earnings distributions the business owners during the current year

The Expanded Accounting Equation is:

Assets = Liabilities + Capital Contributions + Opening Retained Earnings + Revenue - Expenses - Withdrawals

This is the same as the Basic Accounting Equation but it contains more detail on the sources of Equity.

Key Points

The basic Accounting Equation is: Assets = Liabilities + Equity

Assets are the stuff that a business owns that have value.

Liabilities are the stuff that a business owes to third parties.

Equity is the owner's claim on the Net Assets of a business.

A Balance Sheet is a snapshot of the Accounting Equation at a point in time.

This formula is the backbone of Double-Entry Accounting.

The Expanded Accounting Equation breaks Equity down into its core components.

More Accounting Equation Resources

Free Accounting Equation Cheat Sheet

I have summarized all this information in my Accounting Equation Cheat Sheet.

You can download it here for free:

Accounting Equation Video

In this short video I summarize how the Accounting Equation works:

Accounting Equation Practice Questions

You can test your understanding of the Accounting Equation in this short quiz:

I have also made an Accounting Equation Practice Question Pack which you can buy here: